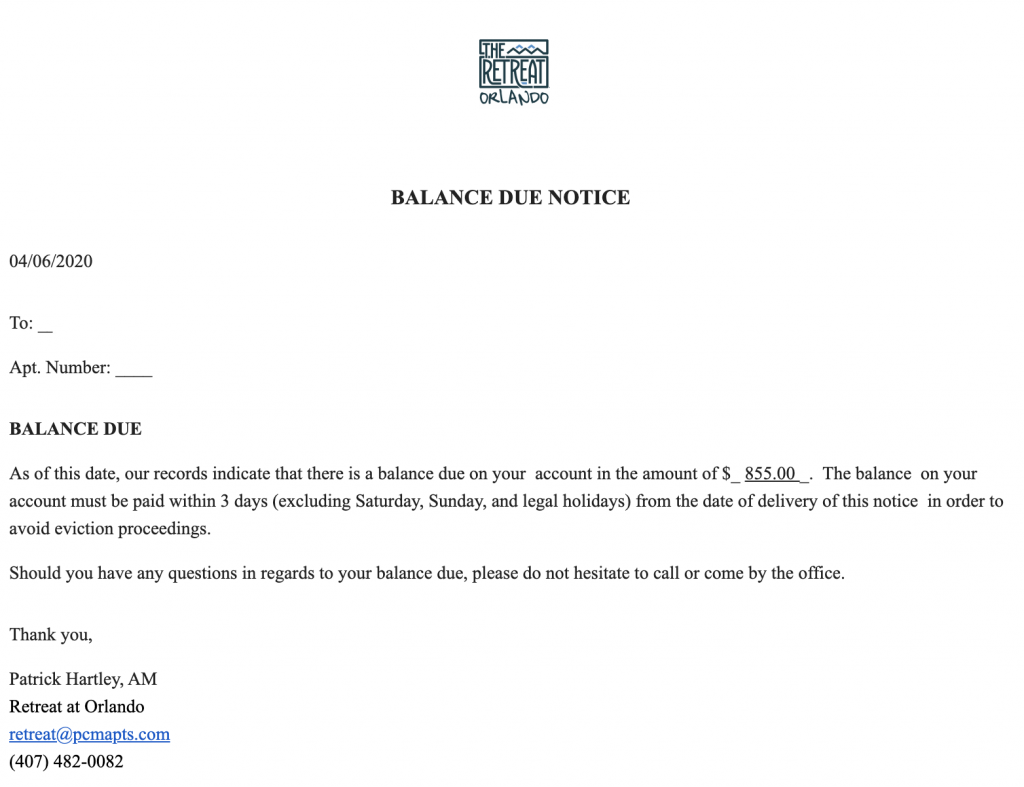

The Retreat at Orlando sent residents an email Monday threatening the possibility of eviction if their balance on the account is not paid within three days.

In an email to Knight News, Senior Vice President of Preferred Apartment Communities William Barkwell said the Retreat did not intend to execute eviction proceedings and is aware of the executive order preventing the eviction of tenants for non-payment.

“This notice was inadvertently generated by our computer system and we submitted the below follow-up letter to the same residents this afternoon at 4:03 PM advising them of the error,” Barkwell said.

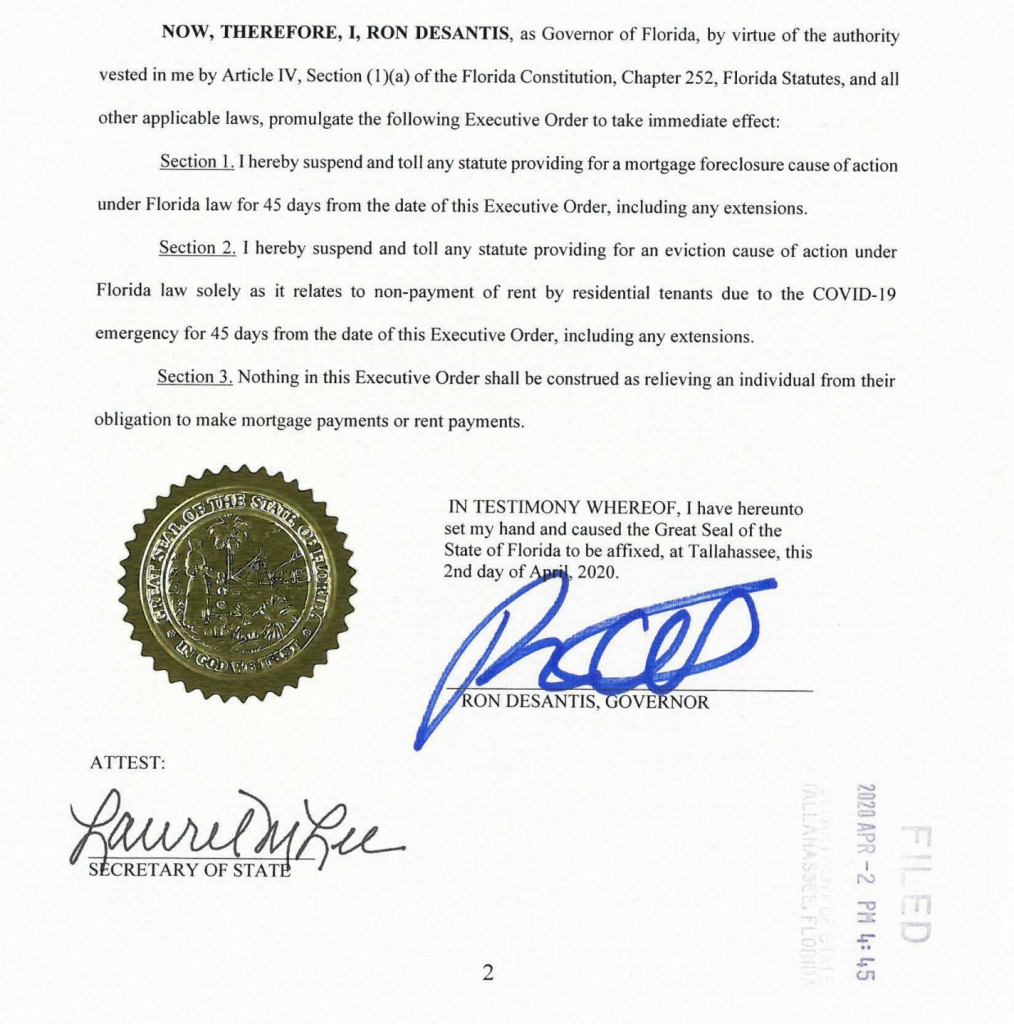

Florida Gov. Ron DeSantis signed an executive order on Thursday suspending all residential evictions for non-payment of rent due to COVID-19.

The executive order prevents eviction for non-payment of rent for 45 days from the date it was signed — April 2. In the Monday email, the Retreat states, “The balance on your account must be paid within 3 days … from the date of delivery of this notice in order to avoid eviction proceedings.”

State Rep. Carlos G. Smith, who represents UCF in Orange County’s District 49, said in a Monday tweet this behavior is unethical and predatory.

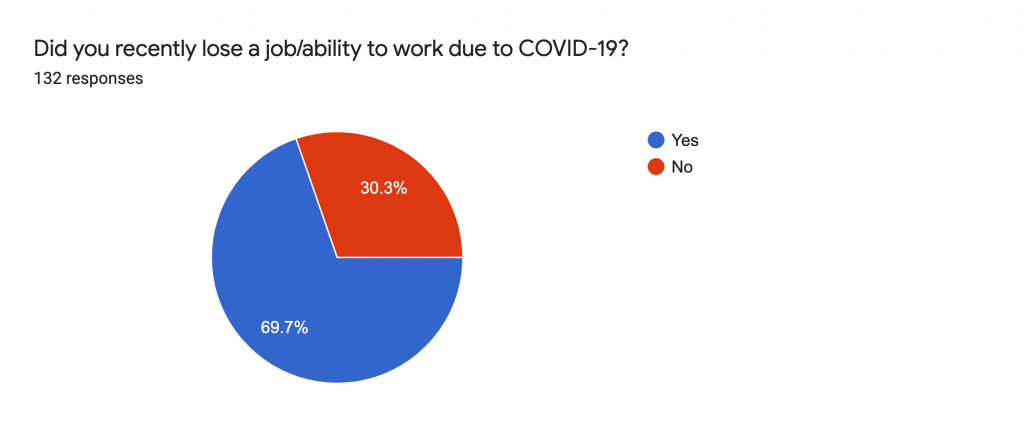

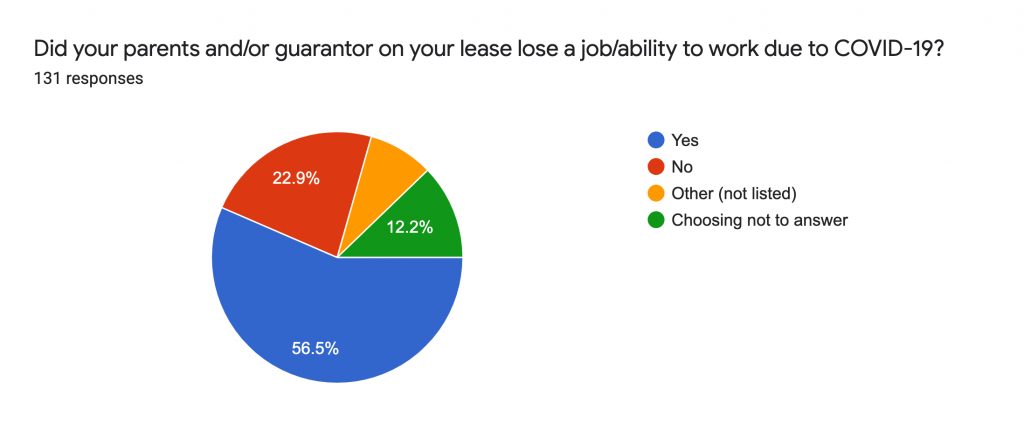

Knight News started a Google Form on Saturday to collect responses and understand the impact on the student population during the COVID-19 pandemic.

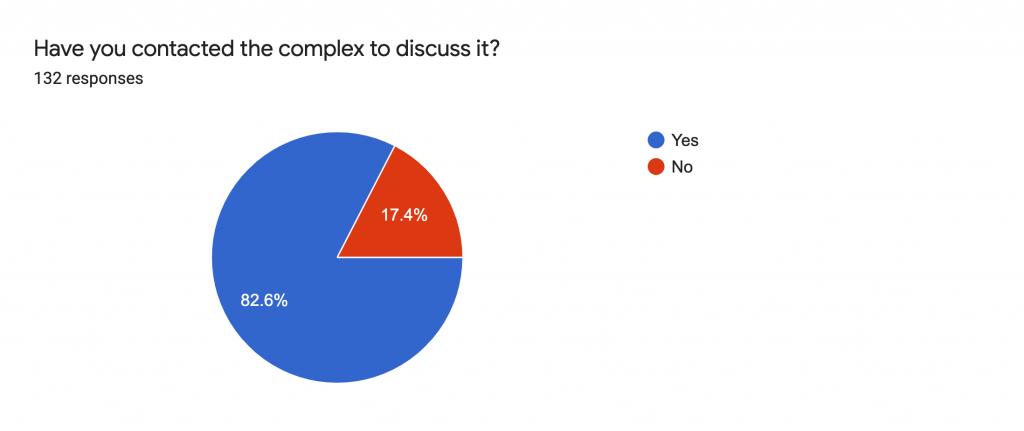

The Housing Concerns – Google Form is still actively accepting responses but at the time of publication, 132 students have answered the series of questions.

About 70% of students that responded have lost their job or ability to work due to the coronavirus.

About 57% of students said their parents or guarantor on the lease of their apartment have also been affected by the COVID-19 pandemic.

Nearly 83% of students have contacted their respective complex to discuss their concerns.

The stimulus bill — created to provide emergency assistance and health care response for individuals, families, and businesses affected by COVID-19 — will not help most college-aged students.

If a student is claimed as a dependent on their parent’s income taxes — meaning their parents provide at least half of their support and they are under the age of 24 years old — they do not qualify for assistance from the stimulus bill.